The COVID-19 has made personal healthcare difficult to attain amidst the increasing burden on healthcare systems. The times are harder if you are older or have a condition that puts your immune system at risk.

Amidst all this, telemedicine makes it easier for you to take care of your skin in the comfort of your home. It also gives you an opportunity to visit a dermatologist quickly, at a very low cost. Your dermatologist reviews your skin condition without requiring you to leave your home,

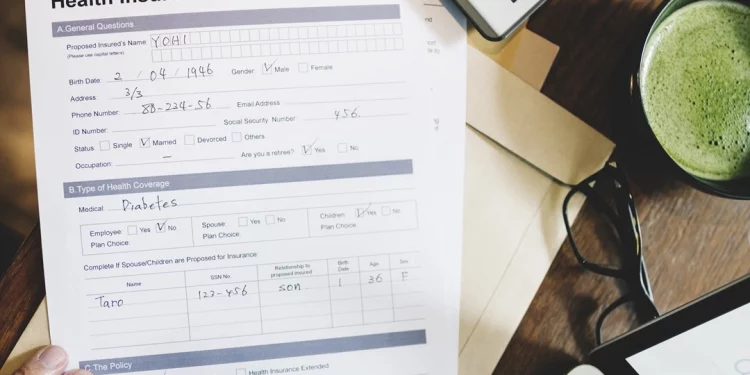

Although your skin specialist has limited access to information regarding what your insurance covers. However, as skincare providers offer a variety of services, it is important that you know what all insurance covers. Whether you are seeking medical, surgical, or cosmetic services, here are some points you need to know:

PCP (Primary Care Physician) referral?

Most insurance companies need a referral to a specialist for information. If your health insurance plan is a POS (point of service) or HMO program (health maintenance organization), you need a referral from your primary care physician (PCP). A primary care physician (PCP), or primary care provider, is a healthcare professional who uses a standard medication. PCPs are the first source of medical help. PCP should be your first step in any non-emergency medical condition.

If you have a PPO (organization of your favorite provider), you may not need a referral. If you have an HMO and do not have a referral or decide to see an offline specialist, you will need to pay out of pocket for your visit to a dermatologist. Most POSs will still include some offline visits when sent from your PCP. You will usually have 90 days to one year to see a dermatologist referred to you, depending on the speciality.

What to do before the appointment?

Review your policy

In most cases, your medical benefit plan will lay the basic access to the policy document or online. This can be a good place to start whether the skincare services are covered or not.

Call your insurance company

Once you have identified what benefits are available for dermatology, call your insurance agent to confirm these benefits before planning your appointment.

Ensure that your dermatologist accepts your insurance

You should confirm that your insurance benefits apply to the dermatologist you are contacting. You must contact your dermatologist to find out if they accept your insurance plan or not. It is better to change your dermatologist if not.

Insurances that may or may not cover dermatology

While your doctor may provide these treatments, your health insurance may or may not pay for these procedures. Often, coverage is reduced by the fact that the insurer considers whether treatment is medically necessary. Hence, if your private health insurance policy considers a medical procedure required, you will be liable for your copay by visitor process.

What to do if the process is not covered?

So, if the procedure recommended by your healthcare provider is not covered by your insurance, talk to them about other options. If payment in advance is not possible, ask to set up a payment plan with your provider in advance. Many practices require a prepaid payment to fit the monthly payment plan. In the end, many medical offices cooperate with outside financial organizations. When considering this option, make sure you read the fine print, especially on late fees and interest rates.

Does Medicare cover Dermatology?

Your risk of getting skin cancer increases as your age increases and it is a major health problem. Most cases of skin cancer – with 50 percent leading to death, come from people of the age 65 and older. If you are an adult, it is important to establish a relationship with a dermatologist. You will also want to investigate health insurance for skincare services and treatment options if you need repeated treatment.

Original Medicare, which includes Part A and B, provides healthcare to Americans age 65 and older. Regular skincare and cosmetic dermatology services, including full skin tests, are usually not covered by the original Medicare. However, Medicare Part B sometimes covers office visits to diagnose or treat a medical condition. This includes skincare if indicated as a medical need, such as a skin test or biopsy to diagnose skin cancer or treat a chronic skin condition.

Even though, times are tough do not let the fear of dermatology insurance or COVID-19 keep you from getting treatment. If it is a bad or persistent skin condition, do not ignore it. Call your dermatologist and ask if it accepts patients without insurance. Ask for a discount if you pay cash or a sliding fee depending on your income. Also, be sure to inquire about co-pays and other profit changes due to this COVID-19 pandemic. Major insurance companies waive copay and deductibles. You will want to determine how long and what kind of services are specific to your system. If you have a self-funded or high-paying plan, you will need to pay for copays and deductibles. Therefore, if your insurance company does not offer a skincare appointment, you can search for a new health insurance plan.

Discussion about this post